There are a few things about me that seem to surprise everyone. For example, despite writing about “e-drama,” I’ve never been much of an internet person. I didn’t even know who Ethan Ralph was until I started writing my first article on the fella. Similarly, while I have a donations page, and a Coinbase account, I’ve never been a big crypto guy.

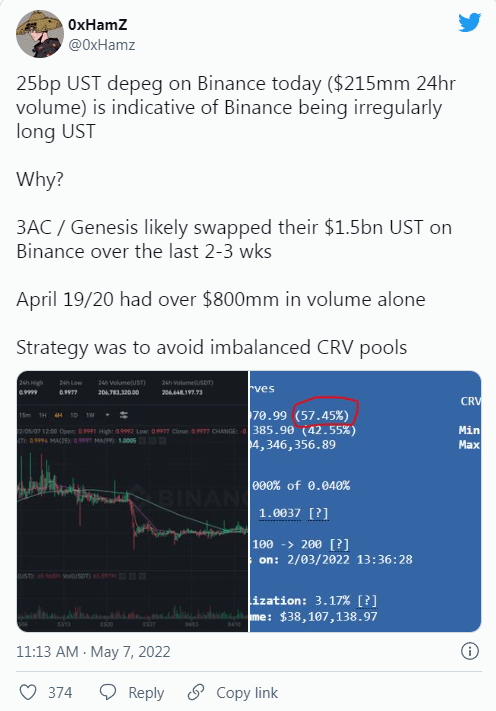

So you can imagine my bafflement when I’m presented with a tweet like the above, especially when coupled with this text.

UST depegged by 0.9% a week after a suspicious amount of UST was accumulated then dumped.

Rumors are that $1.5B in BTC was sold off to protect the peg.

Curve.fi (main stablecoin dex that uses special algorithms to minimize slippage on large trades) has a massive imbalance in their UST+3Crv trading pair, someone has been dumping their UST for other stables.

Billions leaving Anchor as people start realizing there’s risk and the anchor reserves are just 40 days from running out and need another injection of liquidity.

While the market is generally taking a big dump, terra-luna looks to be doing especially badly for such a large mcap.

On the bright side, once all that money flees the unsafe 20% APY ponzi people will want to look for other places to put their bags and BTC is looking cheap these days. So the failure of insane stablecoin staking returns might be what will set us up for the next pump.

Well, I asked what’s going on in that very same thread, and got this as the first answer.

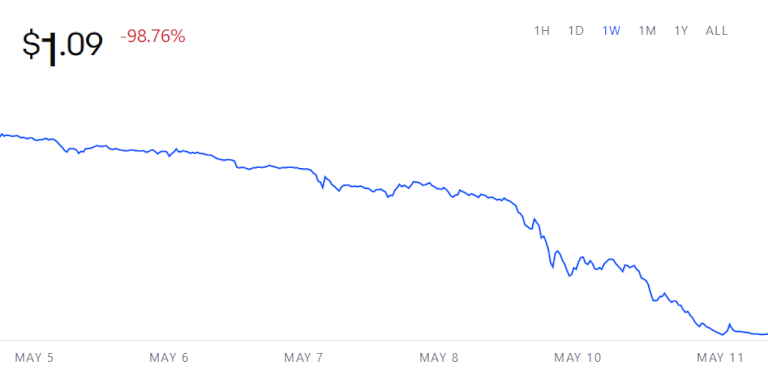

Just my speculative observation, LUNA was probably one of the biggest examples of FOMO in the history of crypto. It was, until recently, a colossal tower of hype built on a foundation of more hype laid on shifty bedrock of even more hype. About a week ago it was trading at I think the high eighties in USD. Today, it is worth about 0.012 per token last I checked.

I am now confused, but in the other direction. My understanding is that cryptocurrencies aren’t really backed by anything. Unlike a fiat currency, which is backed by government force, cryptos are “worth,” whatever the market decides they’re worth. People kept speculating that some new coin called Luna, was going to go up in value. This worked for a long while. Then people started selling, so the price dipped, so more people sold, and so on and so forth. That’s how it decreases by almost 10,000x in valuation in just a few days.

Now I’m just confused how so many people fall for these kinds of things. No offense if you’re reading this and you did of course. We all make mistakes.

Luna was another one of those supposed “solid real-world case” scenarios that sounded too good to be true. Simply stake X number of tokens on the blockchain, sit back and earn 20% APY! So tempting for zoomers everywhere who can’t stand the thought of *gasp* manual labor much less a forty hour work-week. Some believe that proof-of-stake is just a confidence game, it’s only a matter of time before the big rug pull happens. Personally I am in this camp because there are only three things in this world that increase the value of anything, whether it’s a five gram Fortuna gold bar or a virtualized asset: Scarcity (gold is hard to find and is used in industry), numismatic valuation (generally agreed upon value of something based on popular belief – see: fiat, collectible baseball cards, etc) and sweat equity (company stocks increase based on worker production.) LUNA has none of these.

The truth is, LUNA was simply a big pot of nothing, with no actual value for anyone, into which money poured for about a year. So many people jumped on the LUNA hype train for so long, even seasoned analysts mis-interpreted the uptrend as beyond FOMO and thus fiscally sustainable. Except that it wasn’t. Decentralized finance sounds too good to be true. Imagine trading between assets with zero fees!

As perhaps a boomer would say, someone has to pay the piper and there is no such thing as something for nothing. LUNA’s marketing campaign and subsequent hype was incredible, however, reaching the outer spheres of even the most casual crypto investors, that grey, nebulous outer shell of people who signed up for Coinbase within the last year because their kids convinced them to do so.

In other words, Luna price was such a huge bubble that industry experts figured it was too big to be a bubble, and probably reflected some sort of real value. And yet, why? It’s not really based on anything, now is it?

I guess you can say this for all cryptocurrencies, and maybe you should. But at least with the major ones like Bitcoin, they have a certain cache as the main crypto. So for various uses people have for crypto, some legitimate, some illegitimate, you can use Bitcoin, Cardano, Monero, and a few others. I guess Luna was supposed to provide value there as well?

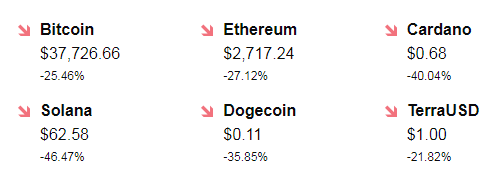

Speaking of those other crypto currencies, they’re not doing so well either. I’ve noticed this with my Cardano account. Losing almost half your value is no fun, but at least I’ve only got around $200 in the first place.

OP chimes in with the following.

Simple explanation and what I figured out after 10min of hearing about how Luna/UST worked:

Fixed 20% APY paid from reserves and not income due to insufficient lending ratio ended up draining liquidity from the protocol, and the more people invest the faster it drains.

UST being minted means Luna is burnt for each UST created, boosting Luna price to the moon. This is an explosive positive feedback loop.

Feedback loops often work in both directions, so it was also an explosive positive feedback loop when UST was cashed out for Luna. To the floor, since being a positive feedback loop means it accelerates down.

Their solution was to use even more of their reserve liquidity to buy BTC and other assets, and those are all correlated with the crypto market and expected to crash when the a stablecoin peg is attacked. Only made sense to buy these assets if you did not intend to sell them.

It was an unstablecoin.

K. So they were offering guaranteed value increases or something?

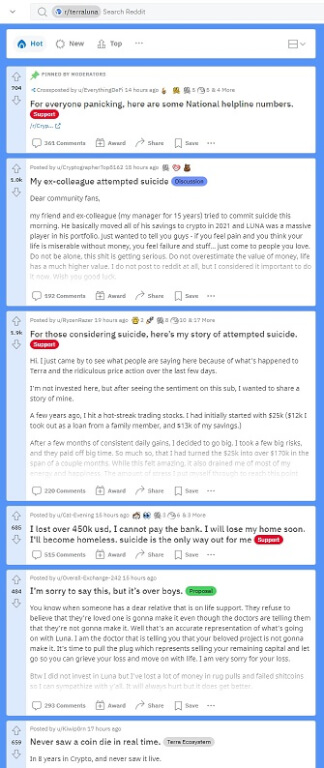

Well anyway, all that really matters is that the coin has gone to zero. This is actually not all that uncommon for financial assets, and it’s never fun to see what this does to people.

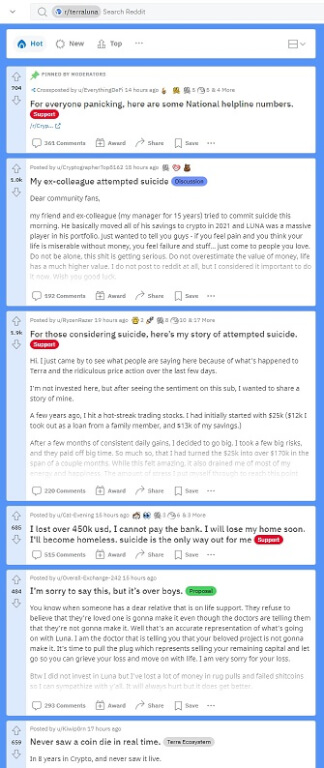

I lost over $450k usd. I cannot pay the bank. I will lose my home soon. I will become homeless. Suicide is the only way out for me.

There is a lot of propaganda when it comes to investing. But here’s an interesting scene from some mid 90’s Matt Damon movie that might help you out.

It’s a two minute watch, and it’ll help you understand the wacky world of finance. You see there is some economic activity, like building a house, that’s actually productive. The way to make money from making houses is to make a lot of them, and make them well.

Then there is other economic activity, like playing poker, where nothing is actually made. And the only way to make money is to have someone else lose money, and get nothing in return. Finance is just the same way, goy.

And that’s when the game isn’t being outright rigged against you, which it often is. Who could forget that now infamous clip of some Wall Street (((Financier))) talking about how their method for making money on shorts was to manipulate the market. Just flat out saying it.

That’s not to say that there isn’t any value to stock investing, but you should know what you’re getting into. There are a lot of young people who have these delusional get rich quick schemes, and crypto currencies play right into that. Same is true for a lot of stocks.

Look, I’m just saying that if you sit down to play poker, and you don’t know who the fish is, he’s you. And if you start trying to invest, and you don’t know who the prey is, he’s you. If you make the wrong moves, you could end up in a bad state.

The morning you read this I’ll be in downtown Vancouver being a poor man’s stenographer for Carey Linde in his fight against institutional child abusers. It’s highly unlikely, but theoretically possible that I’ll face some serious legal retaliation for my work there. It’s a risk, and I don’t directly benefit.

But we all have to take risks for political gain. I just wish that the people who are willing to lose everything financially speculating on some shitcoins had the same approach to politics.