Fewer names have been bigger in cryptocurrencies this year than Sam Bankman-Fried, CEO of crypto exchange FTX. So when it became clear this week that the curly-haired billionaire and his exchange faced a liquidity crunch, he was no longer a billionaire, and his exchange likely wasn’t solvent, it cast a shadow over the entire crypto space and sent digital currencies plummeting.

“Curly haired billionaire.”

I, for one, am getting real sick and tired of all these hook nosed curly haired billionaires subverting our institutions.

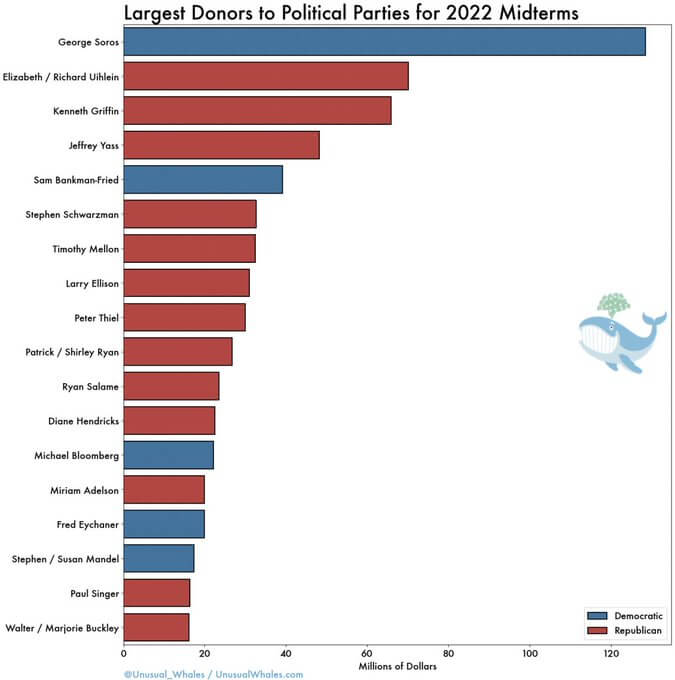

The 30-year-old Bankman-Fried has been a major force in Democratic politics, ranking as the party’s second-biggest individual donor in the 2021–2022 election cycle, according to Open Secrets, with donations totaling $39.8 million. That ranks only behind George Soros (about $128 million) but ahead of many other big names, including Michael Bloomberg ($28.3 million). What’s more, he had promised to spend far more on Democrats moving forward, predicting in May that he’d fund “north of $100 million” and had a “soft ceiling” of $1 billion for the 2024 elections.

Sam Bankman-Fried, George Soros, and Michael Bloomberg are all Jews by the way. They collectively spent over $190 million just on the Democrat Party, and just on the midterms. They join the rest of the mega donor list, which sounds like the regulars at your local synagogue.

It’s also amazing just how much money is spent on midterm elections. The small bars at the bottom are still almost $20 million in spending, and that’s just one individual. Really hammers home how utterly worthless voting for (((donor))) approved parties is.

Federal regulators are now reportedly investigating FTX to determine whether it harmed clients or broke financial regulations after FTX’s implosion, as it saw $5 billion of withdrawals on Sunday alone, many of them prompted by a tweet from the CEO of rival exchange Binance that he was dumping FTX-linked coins. Binance then seemed to come to FTX’s rescue on Tuesday before ditching its 11th-hour bid to buy FTX the very next day. Cryptocurrency prices fell amid concerns about FTX’s solvency and fears of a possible contagion. It’s a head-spinning turn of events for FTX, which was valued north of $30 billion at its peak; and for the crypto space, which has declined in value from $3 trillion to below $2 trillion during this year’s Crypto Winter.

That’s a lot of wealth destroyed, leaving the crypto future uncertain, but it’s also potentially awkward for Democrats, who have drawn huge donations from crypto figures while taking tentative steps toward regulating the space this year. Bankman-Fried was a major donor to President Joe Biden in the 2020 election and is the primary donor to the Protect Our Future PAC, the political action committee which endorsed Democratic candidates such as Peter Welch, who this week won his bid to become Vermont’s next senator, and Robert J. Menendez of New Jersey, who secured a House seat.

The article has a certain “muh DEMONrats,” bent, but it is definitely true that Democrats have zero interest in actually regulating this crooked industry. In the same way that Republicans have zero actual interest in shutting down the border, due to their (((mega-donors))), muh DEMONrats get paid big bucks not just to push anti-Whiteness and AIDS, but to steadfastly avoid doing any sort of real anti-corporate policies.

NBC News Anchor: Why did you choose politics aside from something more charitable?

Sam Bankman-Fried: It’s a good question and you know to be clear we have also given upwards of a hundred million this year to charity.

“Charity.”

Let’s take a look at this charitable giving.

It turns out “effective altruism” isn’t so effective when a billionaire donor’s money dries up.

That realization rang especially true this week for members of the FTX Foundation’s Future Fund, whose entire team resigned on Thursday saying they “are now unable to perform our work or process grants.” The resignation comes amid a continued meltdown at one of the world’s largest crypto currency exchanges which evaporated billionaire founder Sam Bankman-Fried’s wealth seemingly overnight. Now, the founder’s pet project and one of the effective altruism movement’s most important funds appears dead in the water.

Effective altruism refers to the field of research and philanthropy that applies the scientific method and reasoning to maximize charitable giving, typically by relatively wealthy individuals. The movement, (referred to sometimes simply as EA) though broad in adherents, has developed a committed following amongst Silicon Valley’s wealthy founders in recent years. Critics of the movement worry its focus on so-called “longtermism” and opaque ideas like reigning in rogue AI prevents it from properly addressing current economic and social issues. Others argue effective altruism, though often well intentioned, can serve as vehicles for billionaires to avoid paying taxes.

Bankman-Fried himself once described effective altruism as a way to, “get filthy rich, for charity’s sake,” according to Axios.

Effective Altruism is something founded by someone named “Peter Singer.” I shouldn’t have to do this, but…

Singer’s parents were Austrian Jews who immigrated to Australia from Vienna after Austria’s annexation by Nazi Germany in 1938.

Peter Singer

That implies he and FTX were always facilitating harm to its users, but the neoliberal and utilitarian underpinnings of effective altruism allowed him to justify that as a matter of consumer freedom.

A less charitable summary of effective altruism, then, would be that it is little more than a fancy way of saying “the ends justify the means.” Effective altruism also encompasses an emphasis on “long-termism,” which can read like another excuse for mercenary corner-cutting today, so long as you commit your loot to improving tomorrow.

Bankman-Fried grew up in Silicon Valley, where long-termism is a pillar of the libertarian/neoliberal “Californian Ideology,” ideas seemingly shared by the likes of Marc Andreessen, Mark Zuckerberg and Elon Musk.

Of course, we know that self-proclaimed effective altruists are totally full of shit. One of the ways you could get the most bang for your buck is supporting anti-war candidates, especially because this is actually popular with the people, so you could undoubtedly get tons of political wins quite easily. And of course, said wins would translate into stopping the murder of tens, if not hundreds of thousands of people per year, amortized, as well as the devastation that these wars entail. So did Mr. Bankman do that?

Of course not. And none of these Effective Altruists are interested in anti-war activism. They’re just using the tried and true tactic of demanding that we all pretend that their anti-White racial activism is actually altruism, because they crunched the numbers and realized that the best way to do good in the world is to flood your community with Third Worlders. Not Israel of course. That wouldn’t be Effective Altruism. Just your neighbourhood, goy.

Popping over to FTX’s website gives us the above warning, where they themselves outright warn you against depositing, and are not taking on any new clients. As is so often the case, it’s difficult to understand exactly what FTX even is. They’re ostensibly just a crypto trading platform, except that they’re weirdly shady and manipulating the markets.

In early November, crypto publication CoinDesk released a bombshell report that called into question just how stable Bankman-Fried’s empire really was.

The report found that even though Alameda Research and FTX are two separate companies, Alameda’s assets were mostly tied up in FTT, a coin that FTX had invented. Though there’s nothing technically wrong about it, it called into question FTX’s liquidity, CoinDesk reported.

Just days later, things got worse when Changpeng “CZ” Zhao, the CEO of Binance — arguably FTX’s chief rival — decided to liquidate roughly $530 million-worth of FTT. Customers also raced to pull out, and FTX saw an estimated $6 billion in withdrawals over the course of 72 hours, which it struggled to fulfill.

The value of FTT plunged 32%, but rallied once again with Bankman-Fried’s surprise announcement on Tuesday, Nov. 8, that Binance would buy FTX, effectively bailing it out.

On Wednesday, Binance announced it was walking away from the deal, citing findings during due diligence, as well as reports of mishandled customer funds and the possibility of a federal investigation.

The news sent FTT plunging even further — Bankman-Fried saw 94% of his net worth wiped out in a single day.

Strapped for cash, Bankman-Fried began calling other industry rivals, including Coinbase CEO Brian Armstrong, for a bailout – to no avail. On Friday, FTX filed for Chapter 11 bankruptcy and Bankman-Fried resigned as CEO.

In a series of tweets, Bankman-Fried said he “fucked up twice” and chalked up up FTX’s implosion to a combination of high customer withdrawals and his own incorrect estimates of how much debt FTX had taken on.

But a Reuters report suggested that there may be other factors at play. The news service, citing unnamed sources, said that earlier this year, Bankman-Fried transferred customer funds from FTX to Alameda without telling anyone, after Alameda was hit with a series of losses.

FTX is backed by a slew of high-profile investors, including SoftBank Vision Fund, Tiger Global, Sequoia Capital, and BlackRock. Sequoia said this week that it’s marking its investment in FTX down to $0 — the storied VC firm had invested $213.5 million in total in FTX.

Even this doesn’t appear to tell the whole story. You could be forgiven for getting the impression that Sam Bankman-Fried just had two different companies for some valid reason. That one of his companies started experiencing losses, so he just happened to transfer money from one of his corporations to shore up the losses, for valid reasons. Then he just made a whoopsie, and accidentally invested heavily from the second corporation into a coin held by the first corporation. Of course, investing in a coin that is owned by you is a great way of upping the price, but hey, maybe he was just accidentally manipulating the markets in his favour. Okay, that would be pretty silly, but my point is that the article is not nearly as damning as it ought to be.

MSN:

‘The Devil In Nerd’s Clothes’: How Sam Bankman-Fried’s Cult Of Genius Fooled Everyone

This theme of no one being able to see FTX/Bankman’s fraud is one that you’ll get a lot from the usual suspects. It’s also something that can be easily disproven by a whole host of YouTube videos from normal people, who were calling this guy on his bullshit weeks before everything imploded.

I remind you all that these videos are all over a month old.

And above is a video from two weeks ago where Friedman gets destroyed in a debate with the goy Erik Voorhees. It’s funny how all of the commentators don’t get the clear goy vs jew battle going on here, although they all instinctively side with the goy over the malicious Hebrew bug creature whose parents are Super PAC (((creatures))).

I’ve always been extremely skeptical of crypto currency. I’m not saying it has no value, but it has always looked like the most easily speculated thing in the world, with no intrinsic value, and plenty of sketchiness to go around. That’s definitely the case when you have these types running the infrastructure.

CNBC:

As Sam Bankman-Fried’s FTX enters bankruptcy protection, Reuters reports that between $1 billion to $2 billion of customer funds have vanished from the failed crypto exchange.

Both Reuters and The Wall Street Journal found that Bankman-Fried, now the ex-CEO of FTX, transferred $10 billion of customer funds from his crypto exchange to the digital asset trading house, Alameda Research.

Alameda, also founded by Bankman-Fried, was considered to be a sister company to FTX. Those cozy ties are now under investigation by multiple regulators, including the Department of Justice, as well as the Securities and Exchange Commission, which is probing how FTX handled customer funds, according to multiple reports.

And there’s no guarantee that your investment won’t simply vanish into thin air.

NOTE: The first version of this story may have given people the impression that I thought Mr. Bankman has no money. More likely he has many hundreds of millions squirreled away. After all, we already know that there were many suspicious and seemingly unauthorized money transfers in the billions going on with his two corporations.

Also, this.

you’re prob aware of this but a black guy got caught up in this story and made some tweets that got him fired:

https://twitter.com/bitcoinzay

I am aware but I was saving it for a later piece on the next flareup of YeGate. Still, good find.

This is the second billionaire jew to get outed as a fraud in the past few years, the first one being Adam Neumann of WeWork. So much for Jewish high IQ.

so if i understand things correctly, it seems the individual jews in the us congress voted for money created by the individual jews at the fed and wall street to be sent to the individual jews in the ukraine, who sent it to the ftx individual jews in the bahamas who donated it to the individual jews in the us congress, all the while ignored by the individual jews at the sec and cheered on by the individual jews in the media, and at some future date the individual jews in the jewdiciary including the individual jew us attorney-general will deal with this all fairly and openly? #thenoticing